CBO Budget Projections are Optimistic: Underestimating America’s Fiscal Challenges

The budgetary projections of the Congressional Budget Office (CBO) offer policymakers a rough baseline forecast on which they base their spending, taxation, and debt-management policies. The accuracy of these projections is important because it influences how Congress plans for long-term economic stability and how it responds to fiscal challenges.

In the past, economists noted that for a long time the CBO overestimated the upward trajectory of interest rates. This observation was largely accurate up until about the mid-2010s. As Figure 1 below demonstrates, CBO projections consistently overshot the trajectory of interest rates from 2006 to 2014.

Given this trend, the CBO began to place significant weight on the factors driving interest rates lower, including foreign demand for U.S. securities and an aging population. At the same time, the agency has since placed less weight on structural factors that put upward pressure on interest rates, such as a growing public debt.

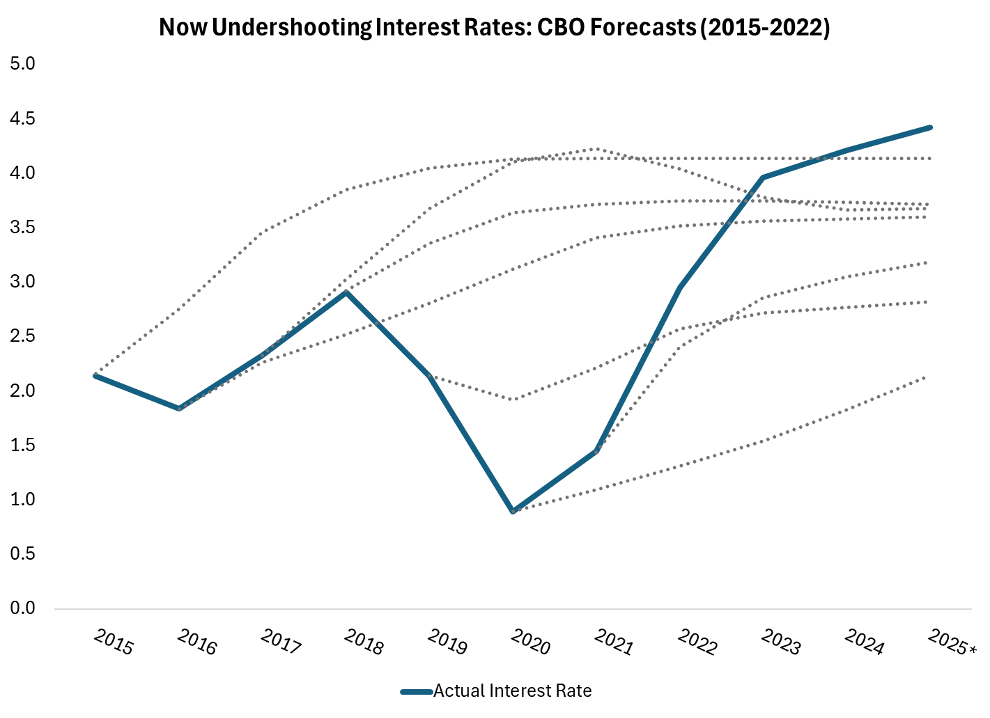

However, the overemphasis on historical structural factors that placed downward pressure on interest rates and the downplaying of fiscal factors has meant that the CBO is now largely undershooting in its forecasts of long-term interest rates. Figure 2 below shows CBO interest rate forecasts from 2015 to 2022 versus the trend movement of actual rates.

The CBO hasn’t just been undershooting its forecast for interest rates in recent years. The track record of the agency in accurately forecasting budget deficits is equally, if not more concerning. In fact, as Figure 3 demonstrates, forecasts for the cumulative 10-year deficit are typically about half the actual value.

For example, in 2014 the CBO projected a cumulative 10-year deficit of less than $7 trillion, yet the 10-year deficit was almost $13 trillion. Similarly, in 2015 the CBO forecast a cumulative deficit of almost $8 trillion and the actual 10-year deficit was over $14 trillion.

These are big misses. This is especially concerning when we consider that the latest CBO projection for the coming 10 years is a cumulative budget deficit of $22 trillion. The undercounting of cumulative budget deficits has serious implications for the forecasting of the nation’s public debt trajectory.

Observing 10-year budget projections over 8 consecutive years (2007–14), CBO has, on average, forecast a 2% increase in the public debt ratio over a decade. In reality, the debt ratio has increased by about 34% on average every decade during this period. Again, this is a significant undershooting. Figure 4 below shows the change in the debt ratio over 10 years, comparing CBO forecasts with actual changes in public debt.

Another way to observe the actual versus forecasted change in the public-debt ratio over 10 years is demonstrated below in Figure 5. Looking 10 years out, the most accurate CBO projection falls short of the actual public debt ratio by 17.5% of GDP, while the least accurate projection falls short by 56%. On average, 10-year projections of the debt ratio undershoot by more than 30% of GDP.

Although the latest CBO report projects the debt ratio will reach 118% of GDP in 2035, it is highly likely, based on the CBO’s record, that the actual debt ratio will far exceed this level.

Given the CBO’s chronic undershooting of interest rates, budget deficits, and debt trajectory in recent years, policymakers should take their budgetary forecasts with a heavy pinch of salt. Higher-than-expected interest rates combined with a higher-than-expected stock of public debt are a recipe for soaring debt service costs, heightened fiscal stress, and a potential loss of market confidence that would drive borrowing costs even higher.