Why Congress Should Let the Enhanced ACA Subsidies Expire

JEC report shows ACA subsidy expansion doubled costs and enriched insurers

With the government now reopened after a five-week shutdown, the stage is set for Congress’ next major fiscal test: whether to extend the enhanced premium subsidies created by the American Rescue Plan Act (ARPA).

As part of the latest budget deal, Democrats secured a promise of a stand-alone vote in December on whether to renew these expanded subsidies set to expire at the end of 2025.

This time, there’s no shutdown to hide behind. The question before Congress is simple: Should taxpayers continue footing the bill for a pandemic-era program that primarily benefits upper-income households and insurance companies?

The Great Conflation

The debate has been muddied by a deliberate conflation of two very different policies. The Affordable Care Act’s original premium tax credits were targeted to lower-income families—those earning up to 400% of the federal poverty level.

The enhanced credits, by contrast, eliminated that income cap. Suddenly, households earning half a million dollars or more became eligible for taxpayer-funded subsidies. The idea was to provide temporary pandemic relief. But like most “temporary” benefits, the policy has proven politically addictive.

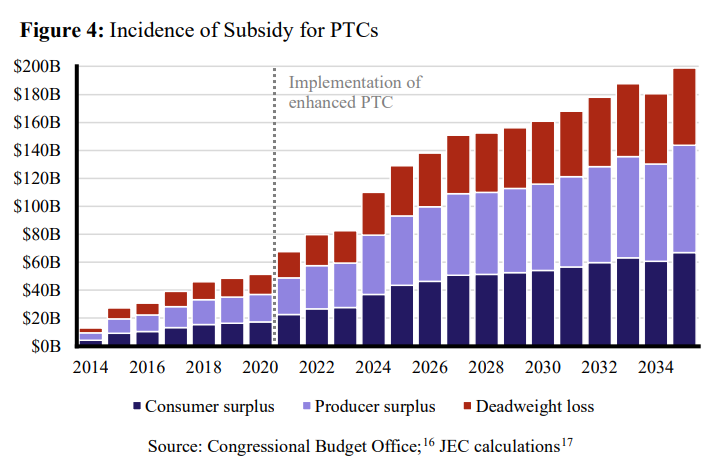

When Congress first scored ARPA in 2021, the Congressional Budget Office projected a modest, temporary bump in subsidy costs. But according to the Joint Economic Committee (JEC), total federal spending on premium tax credits has doubled since the enhanced subsidies were introduced, even after adjusting for medical inflation. Between 2021 and 2024, cumulative outlays exceeded the combined ARPA and Inflation Reduction Act cost estimates by tens of billions of dollars.

Even if the expansion ends as scheduled, 2026 spending will still be twice what was projected before ARPA, as the figure below from the JEC report demonstrates (PTCs = premium tax credits).

This isn’t just a rounding error. It means that Washington’s “temporary” generosity has permanently ratcheted up the baseline cost of the ACA marketplace. Even if the enhanced subsidies lapse, the ACA will remain far more expensive than before the pandemic.

A Badly Targeted and Inefficient Subsidy

Making these enhanced credits permanent would cost more than $400 billion over the next decade, according to the Congressional Budget Office. Yet much of that new spending flows to affluent households, those who were already insured or could afford health coverage without federal assistance. This design makes the policy regressive, channeling billions of dollars to households far above the median income.

And the inefficiency is staggering. Because subsidies are tied to the sticker price of insurance premiums, insurers can capture a large share by quietly raising gross premiums. Consumers see lower net prices, but taxpayers make up for the difference.

The JEC, citing research by Maria Polyakova and Stephen Ryan, finds that for every additional federal dollar spent on ACA subsidies:

· 34 cents lower consumers’ premiums,

· 38 cents go straight to insurers and intermediaries, and

· 28 cents are lost entirely as deadweight losses that benefit no one, as shown in the below bar chart from the JEC report.

In other words, taxpayers now spend three dollars to deliver one dollar in benefit.

The Subsidy Bubble

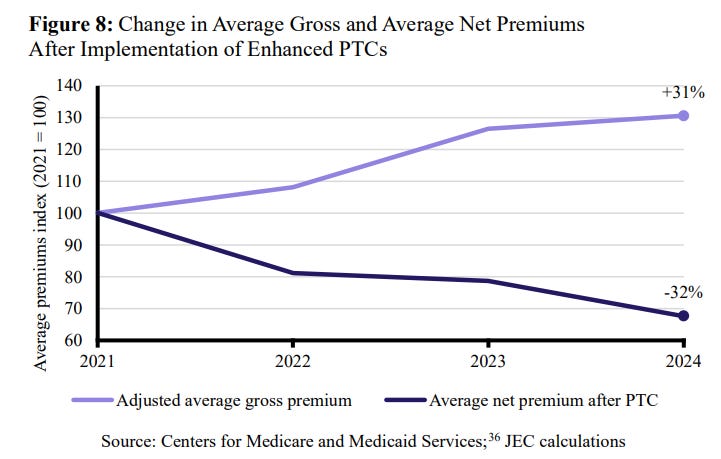

The enhanced credits have also inflated what the JEC calls a “subsidy bubble.” Because the credits are tied to the sticker price of premiums, insurers can raise gross premiums without losing customers—taxpayers simply cover the difference.

As a result, since 2021, insurers’ gross premiums have risen by 31%, while the average net premium paid by consumers has fallen by 32%, as illustrated in the JEC’s figure below.

That divergence is not a sign of success; it’s a symptom of hidden inflation. Consumers see “stable” prices, but only because Washington is subsidizing the increase. When the bubble eventually bursts, either through policy expiration or fiscal necessity, the result will be sticker shock. Maintaining the bubble indefinitely would be even worse: It locks in higher costs and ever-growing subsidies.

Weakening Competition and Subsidizing Waste

As the share of consumers paying little or nothing in premiums has soared to 42%, price competition has eroded. Insurers face less pressure to cut costs or innovate and more incentive to pad margins.

According to the JEC, enhanced subsidies have shifted the balance of benefits decisively away from consumers. In fact, the amount of subsidy spending that is now wasted or captured by insurers roughly equals the total consumer benefit that existed before the expansion. It’s the classic pattern of captured regulation: A policy sold as consumer protection becomes an industry entitlement.

Washington’s Inverted Priorities

By 2035, the cost of these enhanced subsidies will reach the equivalent of $11,500 per taxpayer. And the beneficiaries are not struggling families; they’re insurers and high-income households who would have bought insurance anyway.

At a time when entitlement programs like Medicare and Social Security are already squeezing the federal budget, doubling down on an inefficient, regressive and distortionary subsidy is indefensible.

The fight over the enhanced ACA subsidies epitomizes Washington’s inversion of priorities: policymakers tripping over themselves to protect a temporary pandemic perk for the well-off, while ignoring the long-term drivers of fiscal imbalance.

Let Them Expire

When Congress votes next month, the choice will be clear. Extending the enhanced subsidies means endorsing a policy that has outlived its purpose, failed the efficiency test and warped the market it was meant to improve.

Letting them expire would not dismantle the ACA. It would simply unwind a temporary pandemic giveaway that has become an enduring transfer to the affluent and the politically connected.

Fiscal responsibility requires more than rhetoric; it requires the courage to stop funding programs that don’t work.